Schedule a Meeting With Fred Paiva or Call 860-758-1400

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Paiva Insurance & Tax Services, Inc., deems reliable but in no way does Paiva Insurance & Tax Services, Inc. guarantee its accuracy or completeness. Paiva Insurance & Tax Services, Inc. had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Paiva Insurance & Tax Services, Inc.. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Paiva Insurance & Tax Services, Inc., execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

7 Things You’ll Be Happy You Downgraded in Retirement

Downsizing for retirement is a good way to simplify your life and cut down on expenses. Making some key changes, like moving into a smaller home, could reduce financial strain and improve your quality of life. It could also give you room to grow in new, unexpected...

Why Your Current Retirement Plan May Not Be Enough in 2025

Retirement: the wonderful time of life when you no longer have to work for your money. Instead, your money is finally working for you. If you’re well on your way to retirement, kudos to you. Today, more Americans are retiring than ever before. According to...

Key change coming for 401(k) ‘max savers’ in 2025, expert says — here’s what you need to know

Key Points Many Americans face a retirement savings shortfall, but setting aside more could get easier for some older workers in 2025. Enacted in 2022, the Secure Act 2.0 ushered in several retirement system improvements, including higher 401(k) plan catch-up...

What the Fed’s Rate Cut Means for You

The Federal Reserve just reduced interest rates for the first time in four years. Here’s how it will impact borrowers and saver What goes up must come down, and after four years, that’s finally true about interest rates. The Federal Reserve cut its benchmark rate on...

Social Security COLA 2025: How Much Will Payments Increase Next Year?

With inflation cooling, analysts estimate benefit boost could come in around 2.5% The second of three numbers the Social Security Administration (SSA) will use to determine the 2025 cost-of-living adjustment (COLA) is in, and it points to a more modest increase in...

Social Security COLA 2025: How Much Will Payments Increase Next Year?

With inflation cooling, analysts estimate benefit boost could come in around 2.5% The second of three numbers the Social Security Administration (SSA) will use to determine the 2025 cost-of-living adjustment (COLA) is in, and it points to a more modest increase in...

Why Retirement Gets Better With Annuities

Everyone aspires to have a steady source of income after retirement that replaces as much as possible of their pre-retirement earning. But for many people, one big challenge in saving for that goal is to find the right financial product that accommodates their...

Results From the 2024 Retirement Confidence Survey Find Workers’ and Retirees’ Confidence Has Not Recovered From the Significant Drop Seen in 2023, but Majorities Remain Optimistic About Retirement Prospects

Summary - However, almost 8 in 10 workers and 7 in 10 retirees are concerned that the U. S. government could make significant changes to the American retirement system - A new report published today from the 34th annual Retirement Confidence Survey finds workers’ and...

2024 Pulse of the American Retiree Survey: Midlife Retirement ‘Crisis’ or a 10-Year Opportunity?

Critically underprepared for retirement, 55-year-old Americans enter a crucial 10-year countdown to plan and prepare With just a decade until retirement, 55-year-old Americans have less than $50K in median retirement savings First modern generation confronting...

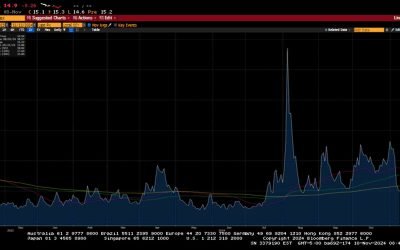

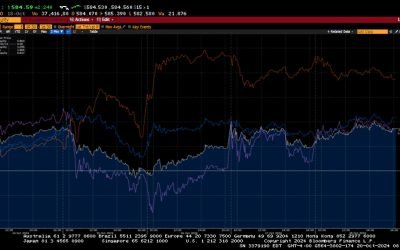

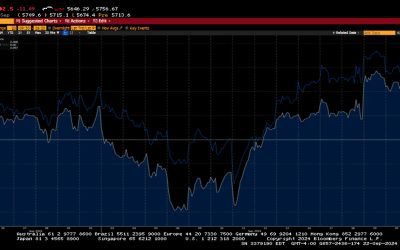

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the idea that President-Elect Trump would enact several pro-growth policies to bolster corporate profits. ...

Weekly Market Commentary

-Darren Leavitt, CFA It was a very busy week on Wall Street as investors analyzed a deluge of corporate earnings reports and a full economic data calendar. The S&P 500 traded lower for the second consecutive week and could not close out October with a gain,...

Weekly Market Commentary

-Darren Leavitt, CFA Global markets pulled back last week as investors took the opportunity to reduce some risk before a very close US Presidential election. In the US, nearly 20% of the S&P 500 reported earnings. Generally, results came in better than expected;...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 advanced for the sixth consecutive week, closing at a new record high. This week, a broadening out of the market’s rally was evident, with small caps and the equally weighted S&P 500 index outperforming. Markets also appear to...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 and Dow Jones Industrial Average forged another set of all-time highs despite facing several macro headwinds. Chinese markets reopened after celebrating Golden Week with significant losses. Investors were expecting an announcement...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 closed higher for a fourth consecutive quarter, the first time it has done so since 2011. Investors continued to face a challenging macro environment. Escalating tensions in the Middle East, a Longshoremen’s strike, the aftermath...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets posted a third week of gains as global central banks continued to cut monetary policy rates. China, Switzerland, Mexico, Hungry, and the Czech Republic cut their policy rates. Chinese markets gained on the news that several...

Weekly Market Commentary

The S&P 500 notched its 39th record high in 2024 on the back of a fifty-basis-point rate cut by the Federal Reserve. Global central banks took center stage this week, with the Fed playing the headliner. Leading into the Fed’s decision, the street was divided over...

Weekly Market Commentary

-Darren Leavitt, CFA Markets bounced back nicely in the second week of September. It was an intriguing week of trade with several undercurrents to consider. The first and likely only Presidential debate between Harris and Trump appeared to be won by Harris, although...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Paiva Insurance & Tax Services, Inc.) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Paiva Insurance & Tax Services, Inc..

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

The “Still-Working Exception” and December 31 Retirement

By Ian Berger, JD IRA Analyst As the end of the year approaches, you may have plans to retire on December 31. However, if you are using the “still-working exception” to defer required minimum distributions (RMDs) from your 401(k) (or other company plan), you may want...

2025 Year-End Retirement Account Deadlines

By Sarah Brenner, JD Director of Retirement Education The end of the year always brings a flurry of retirement account deadlines and planning opportunities. This year is no different. And, new for 2025, the One Big Beautiful Bill Act (OBBBA) brings new...

Qualified Distributions and Successor Beneficiaries: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Dear IRA Help, Here is my specific case. I am 84 years old. I opened a Roth IRA on March 30, 2020, with a conversion. I started withdrawing from this conversion on March 10, 2025. Did I satisfy the...

Do QCDs Actually Reduce AGI?

By Andy Ives, CFP®, AIF® IRA Analyst It has come to our attention that confusion exists as to how qualified charitable distributions (QCDs) impact one’s taxes. It is said that QCDs can reduce adjusted gross income (AGI). But is this true? Yes, it is true…but...

Trump Accounts and the Pro-Rata Rule: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: We have two grandchildren. One is 18 years old now, and the other will turn 18 next January (2026). Can you help me understand what I can do for each under the new Trump account rules? Ollie Answer: Hi Ollie, You will...

Avoiding the 10% Early Distribution Penalty for Certain Hardship Withdrawals

By Ian Berger, JD IRA Analyst Most 401(k) plans (as well as 403(b) and 457(b) plans) offer hardship withdrawals while you are still employed. If the withdrawal comes from a pre-tax account, it will be taxable. And, if you’re under age 59½, it will also be subject to...

Tapping an ESA for Back-to-School Expenses

By Sarah Brenner, JD Director of Retirement Education It’s August and that means it is back-to-school time! The 2025-2026 school year is upon us. Kids are already back in the classroom and ready to learn. Any parent will tell you that back-to-school time is an...

The Once-Per-Year Rollover Rule and SEP IRA Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: I recently retired in January and rolled over a lump sum pension from my previous employer into my IRA. Next month, I’m planning to roll over my 401(k) from the same employer into the same IRA as well....

The Craziest Stuff I’ve Heard

By Andy Ives, CFP®, AIF® IRA Analyst The Ed Slott team has answered literally tens of thousands of IRA and retirement plan questions over the past few years. That is not hyperbole—we track it all. The questions we’re asked run the gamut from basic to extremely...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Paiva Insurance & Tax Services, Inc., deems reliable but in no way does Paiva Insurance & Tax Services, Inc. guarantee its accuracy or completeness. Paiva Insurance & Tax Services, Inc. had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Paiva Insurance & Tax Services, Inc.. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Paiva Insurance & Tax Services, Inc., execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Unpacking the changes to Medicare in 2025

Medicare coverage is personal — and changes to those plans and benefits may feel unnerving as it affects one’s overall health and well-being. Originally passed in 2022, the Inflation Reduction Act brought about many changes to Medicare that are now being implemented...

read more

What If My Medicare Doctor “Opts Out”?

Finding a doctor you like and trust can be a long process, so I understand that it can be frustrating when your doctor no longer accepts Medicare. If your doctor has “opted out” of Medicare, this means that he or she no longer accepts Medicare assignment...

read more

Home health care through Medicare

It’s important to plan for your health care needs, but sometimes life throws unexpected curve balls. And when that happens, you’ll need to know what’s covered. Fortunately, there are ways you and your loved ones can get the necessary care at home. Here’s what you need...

read more

Correcting the Record: The Facts on Medicare Advantage Payment and Accountability

The Wall Street Journal recently published a story regarding diagnoses and plan payments in Medicare Advantage. The story was fundamentally flawed and overlooked the value of Medicare Advantage for millions of American seniors. Here are the facts: More than 33 million...

read more

New bipartisan survey reveals a supermajority of seniors oppose reducing funding to Medicare Advantage — and will factor that into their vote in November

Today, more Americans than ever are choosing Medicare Advantage for affordable, quality health care — with over 33 million seniors and people with disabilities enrolled in the program. BMA wanted to learn more about seniors’ views on Medicare Advantage and how...

read more

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One...

read more

Will My Specialist’s Services be Covered under My Medicare Plan?

Whether you’re switching from one type of Medicare coverage to another, or you’re new to Medicare, you might be concerned about being able to continue seeing your health-care specialist. Will your specialist’s services be covered by Medicare? That may depend upon:...

read more

7 Medicare Changes You’ll See in 2025

Expensive medications? You’ll save thousands. Dementia or mental health care? More options Key takeaways Changes from Inflation Reduction Act will take effect next year. Lower out-of-pocket limit in Part D drug plans erases old “donut hole.” You may find weight loss...

read more

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One of the most effective ways to ensure seniors receive comprehensive care...

read more

Unpacking the changes to Medicare in 2025

Medicare coverage is personal — and changes to those plans and benefits may feel unnerving as it affects one’s overall health and well-being. Originally passed in 2022, the Inflation Reduction Act brought about many changes to Medicare that are now being implemented...

What If My Medicare Doctor “Opts Out”?

Finding a doctor you like and trust can be a long process, so I understand that it can be frustrating when your doctor no longer accepts Medicare. If your doctor has “opted out” of Medicare, this means that he or she no longer accepts Medicare assignment...

Home health care through Medicare

It’s important to plan for your health care needs, but sometimes life throws unexpected curve balls. And when that happens, you’ll need to know what’s covered. Fortunately, there are ways you and your loved ones can get the necessary care at home. Here’s what you need...

Correcting the Record: The Facts on Medicare Advantage Payment and Accountability

The Wall Street Journal recently published a story regarding diagnoses and plan payments in Medicare Advantage. The story was fundamentally flawed and overlooked the value of Medicare Advantage for millions of American seniors. Here are the facts: More than 33 million...

New bipartisan survey reveals a supermajority of seniors oppose reducing funding to Medicare Advantage — and will factor that into their vote in November

Today, more Americans than ever are choosing Medicare Advantage for affordable, quality health care — with over 33 million seniors and people with disabilities enrolled in the program. BMA wanted to learn more about seniors’ views on Medicare Advantage and how...

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One...

Will My Specialist’s Services be Covered under My Medicare Plan?

Whether you’re switching from one type of Medicare coverage to another, or you’re new to Medicare, you might be concerned about being able to continue seeing your health-care specialist. Will your specialist’s services be covered by Medicare? That may depend upon:...

7 Medicare Changes You’ll See in 2025

Expensive medications? You’ll save thousands. Dementia or mental health care? More options Key takeaways Changes from Inflation Reduction Act will take effect next year. Lower out-of-pocket limit in Part D drug plans erases old “donut hole.” You may find weight loss...

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One of the most effective ways to ensure seniors receive comprehensive care...

Regular Review

Your life will change. And your plan must change with it. At our regular plan reviews we check for progress, realign to new information, and address any information that is out of date. Our support team is here for you to get you the answers you need when you need them. Regular plan reviews are just another part of doing it the right way.