Schedule a Meeting With Fred Paiva or Call 860-758-1400

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Paiva Insurance & Tax Services, Inc., deems reliable but in no way does Paiva Insurance & Tax Services, Inc. guarantee its accuracy or completeness. Paiva Insurance & Tax Services, Inc. had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Paiva Insurance & Tax Services, Inc.. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Paiva Insurance & Tax Services, Inc., execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Why Retirees Are Carrying More and More Debt

Federal Reserve data shows sharp rise in amount Americans 65 and older owe Americans across generations are carrying more debt than they did three decades ago, according to Federal Reserve data, but the rise has been especially steep among the oldest age groups. The...

3 Changes Coming To Retirement Required Minimum Distributions in 2025

Saving and investing early, often, and continuously throughout your entire working career is absolutely critical to securing your financial future in retirement. Making contributions to your 401(k) or IRA provides tax benefits, allowing you to defer taxes owed on your...

3 Changes Are Coming to 401(k) Plans in 2025

Three significant 401(k) plan changes coming in 2025 are worth paying attention to, regardless of when you plan to retire, whether you work full-time or part-time, or whether you even have a 401(k) yet. In late 2022, Congress passed a law to help savers build their...

6 Retirement Savings Changes To Expect in 2025

Big changes are coming to retirement savings in 2025. The shifts in retirement planning come after Congress passed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) in 2019 and its 2022 follow-up, the SECURE 2.0, which further expanded and...

7 Things to Know About Working While Getting Social Security

If you claim benefits early, income from work can reduce your monthly payments “Retirement” used to be synonymous with “not working.” Not anymore. More than a quarter of U.S. adults ages 65 to 74 are still in the workforce, according to the federal Bureau of Labor...

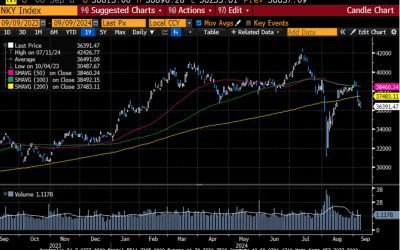

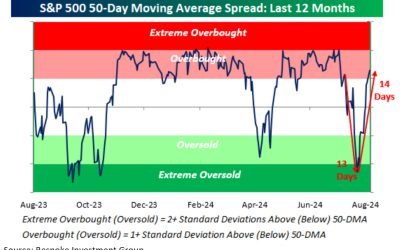

Weekly Market Commentary

-Darren Leavitt, CFA Global equity markets tumbled due to economic growth concerns as the US Treasuries extended their gains from August. The holiday-shortened week started with weaker-than-anticipated manufacturing data out of China, which highlighted just how weak...

Weekly Market Commentary

-Darren Leavitt, CFA The final week of August was all about NVidia's second-quarter earnings results and the Fed's preferred measure of inflation, the PCE. Expectations for NVidia's earnings were so high that some decided to throw pre/post-earnings parties to...

Weekly Market Commentary

-Darren Leavitt, CFA US financial markets inked another week of gains as investors cheered what they heard from global central bankers at the Jackson Hole Economic Symposium. In fact, the bulk of the gains were made on Friday after Fed Chairman Jerome Powell...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Paiva Insurance & Tax Services, Inc.) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Paiva Insurance & Tax Services, Inc..

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

In ERISA Retirement Plans, Spouse Beneficiaries Rule

By Ian Berger, JD IRA Analyst At Ed Slott and Company, we continually stress how important the beneficiary designation form is. Because it’s that form – and not the retirement account owner’s will or other estate planning documents – that usually dictates who...

Required Minimum Distributions and IRA Beneficiaries: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: I turn age 73 on December 1, 2026. I would like to do a Roth IRA conversion on January 1, 2026, prior to turning 73 years old. Does my first required minimum distribution (RMD) begin January 1, 2026, the year that I turn...

5 Random Retirement Account Trivia Questions

By Andy Ives, CFP®, AIF® IRA Analyst Are the current tax brackets, made “permanent” by OBBBA, really here forever? Not necessarily. The One Big Beautiful Bill Act (OBBBA) did extend the tax rates established by the 2017 Tax Cuts and Jobs Act “permanently.” But that...

QCDs and 529-to-Roth IRA Rollovers: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: I am 70 years old and do not have to start taking required minimum distributions (RMDs) for three years. Can I do a qualified charitable distribution (QCD) from my IRA now? Or, do I have to wait until age 73 when I have to start...

Six Unanswered Questions on Trump Accounts

By Ian Berger, JD IRA Analyst A recent Slott Report article discussed “Trump accounts,” the new savings vehicle for children created by the One Big Beautiful Bill Act (OBBBA). As with most new laws, there are a number of unanswered questions about Trump accounts that...

Mr. T: “I Pity the Fool Who Misses Their RMD”

By Sarah Brenner, JD Director of Retirement Education Laurence Tureaud, born May 21, 1952, is better known as Mr. T. He is an actor and a retired professional wrestler. He is famous for his roles as B. A. Baracus in the 1980s television series “The A-Team” and as...

Required Minimum Distributions and IRA Transfers: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Can I satisfy my required minimum distribution (RMD) from my 401(k) by taking it from my IRA instead? Answer: No, that is not allowed. You may aggregate RMDs from your IRAs if you have multiple accounts,...

Reporting a Recharacterization

By Andy Ives, CFP®, AIF® IRA Analyst While the ability to recharacterize Roth conversions was eliminated years ago, Roth contributions can still be reversed. A Roth IRA contribution can be recharacterized to a traditional IRA, or vice versa. To recharacterize an IRA...

Roth IRA vs. Roth 401(k): Which Is Better?

By Ian Berger, JD IRA Analyst Many of you are familiar with the tax advantages that Roth retirement accounts can bring. Although Roth contributions are made with after-tax dollars, the contributions grow tax-free, and earnings also come out tax-free after age 59½ if a...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Paiva Insurance & Tax Services, Inc., deems reliable but in no way does Paiva Insurance & Tax Services, Inc. guarantee its accuracy or completeness. Paiva Insurance & Tax Services, Inc. had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Paiva Insurance & Tax Services, Inc.. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Paiva Insurance & Tax Services, Inc., execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Does your Medicare plan cover gym memberships and other fitness benefits?

There’s no age limit on exercise – physical activity is for everyone! In fact, as you get older, physical activity becomes an even more important part of your overall health. According to the Centers for Disease Control and Prevention, regular exercise can help...

read more

Does your Medicare plan cover gym memberships and other fitness benefits?

There’s no age limit on exercise – physical activity is for everyone! In fact, as you get older, physical activity becomes an even more important part of your overall health. According to the Centers for Disease Control and Prevention, regular exercise can help...

Regular Review

Your life will change. And your plan must change with it. At our regular plan reviews we check for progress, realign to new information, and address any information that is out of date. Our support team is here for you to get you the answers you need when you need them. Regular plan reviews are just another part of doing it the right way.